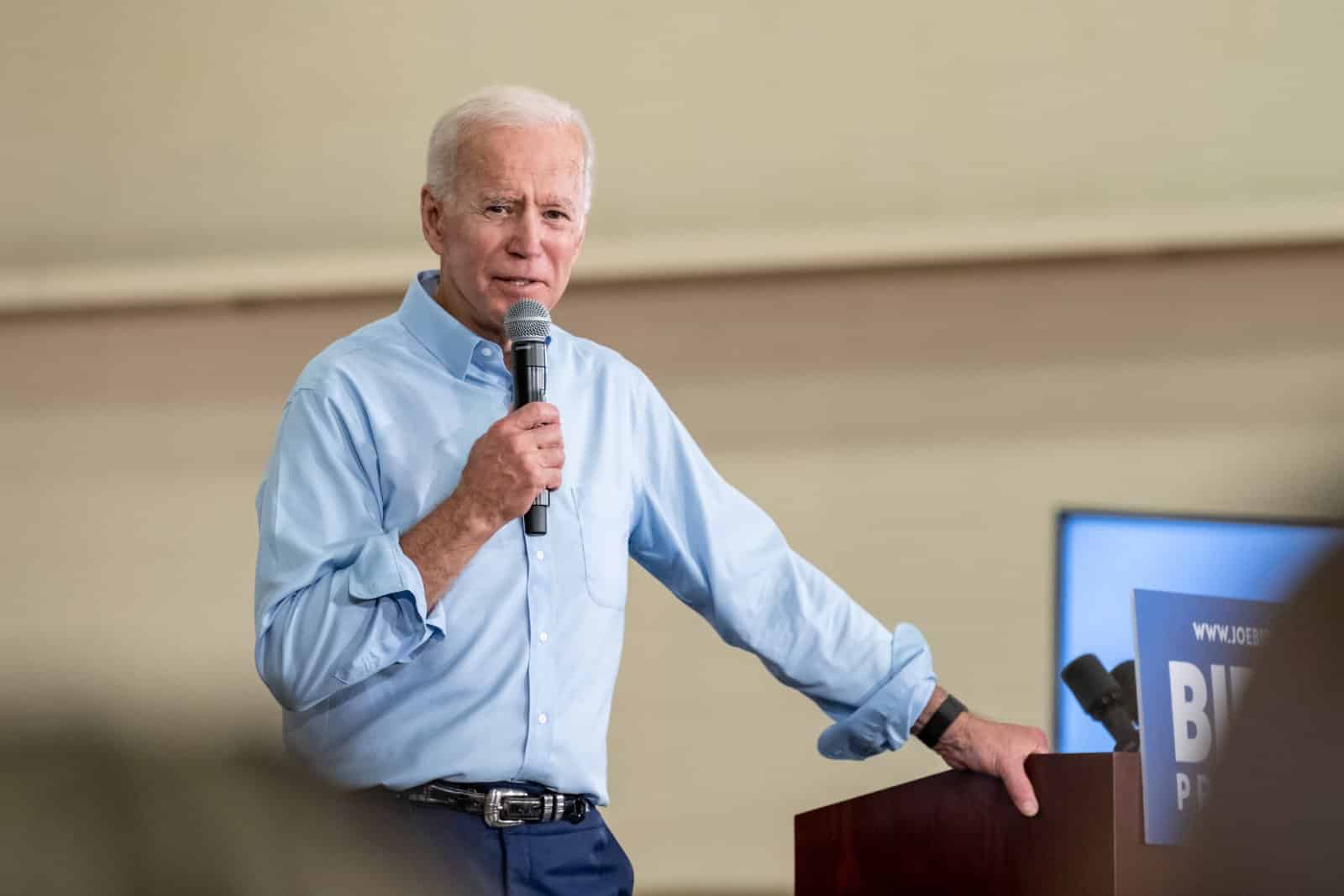

President Joe Biden’s recent budget proposal for 2025 is causing a stir across the nation. With a plan to increase spending to $7.3 trillion, Biden aims to address major social programs and tax reforms. Underpinning the plans are increased taxes on the wealthy to fund social security and Medicare, which would bring about much-needed change in financial equity and social welfare in the United States.

A Direct Challenge to Wealth

Biden’s budget boldly suggests increasing taxes on billionaires and large corporations. The Administration hopes that this will create a fairer tax system, as it advocates for a minimum 25% tax rate on unrealized income of the wealthiest households. This strategy will make it possible to fund essential social programs and also reduce the national deficit by $3 trillion over the next decade.

Standing Firm Against Entitlement Cuts

In contrast to Trump’s suggestions to cut entitlement programs, Biden emphasizes protecting Social Security and Medicare.

“I’m never going to allow that to happen,” Biden stated, directly opposing any reductions to these critical safety nets.

Reinforcing Medicare and Social Security

The proposal includes measures to strengthen Medicare and Social Security, leveraging federal negotiating power to reduce prescription drug prices.

These efforts aim to ensure the longevity and sustainability of these programs, critical for millions of Americans.

A Reaction to Opposition

Despite potential resistance, Biden remains committed to his tax reform agenda. The proposal reflects a continued effort to implement a progressive tax system, despite previous challenges in a divided Congress.

Biden’s persistence highlights his dedication to reshaping economic policy for fairness.

Budget as an Election Statement

As Biden gears up for a potential re-election battle, his budget doubles as a declaration of his economic priorities.

Taxing the wealthy to fund social programs stands as a key message to voters, a significant contrast in policy vision from his opponents’.

Historical Context of Tax Proposals

The idea of taxing the rich is not new in Biden’s presidency. Despite challenges in Congress, including the recent shift in the House majority, Biden’s budget reiterates his unwavering commitment to this principle.

Economic Policy as a Campaign Cornerstone

Biden’s budget announcement serves not only as a financial plan but also as a campaign cornerstone, emphasizing his commitment to protect social programs and ensure tax fairness.

This approach aims to resonate with voters concerned about economic equity and the future of social security.

Public Opinion on Biden’s Economic Moves

Lately, more people seem to be giving Biden a thumbs-up for how he’s handling the economy. His approval ratings are on the up, suggesting his budget plan and focus on making things fair might be hitting the right notes with the public.

This shift indicates a growing challenge to the usual complaints about prices and big companies having too much control.

Big Companies and Their Impact on Prices

Biden has been focusing on how some big companies set their prices, which can really squeeze everyone’s wallet. He is even rolling out a special team aimed at cracking down on price gouging, a “Strike Force on Unfair and Illegal Pricing.”

This move is all about tackling the grip these companies have on what Americans pay for everyday.

Making the Wealthy Pay Their Fair Share

The new budget plan is forthright about getting more tax dollars from the super-rich and big businesses. The idea is to make sure they are contributing a fair share to the economy.

Protecting Medicare and Social Security

A big piece of Biden’s budget puzzle is making sure Medicare and Social Security are on solid ground. He is looking at different ways to save money and make these programs stronger, so they can keep going strong for years to come.

Biden Claps Back at Critics

With some Republicans calling Biden’s budget plan irresponsible, he continues to defend his plan as a way to keep up support for important programs and make the tax system fairer.

An Election Year Gambit

As the election looms, Biden’s budget proposal represents a gambit to win voter support through clear policy distinctions.

By emphasizing tax fairness and social program protection, Biden is looking to mobilize electoral support around his vision for America’s economic future.

Fairness and Equity

Biden’s budget proposal clearly outlines a vision for the future of American financial policy, centered on fairness, equity, and the protection of essential social programs.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, they items have become valued objects and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

10 Reasons Firearms Are Essential to America’s Fabric

Americans’ strong attachment to guns is influenced by constitutional rights, historical context, and cultural traditions. This article explores the cultural perspective driving their unwavering support for gun ownership, revealing the key factors shaping this enduring aspect of American life. 10 Reasons Firearms Are Essential to America’s Fabric

California’s 16 New Laws Raise Red Flags for Prospective Residents

California, celebrated for its beaches, tech prowess, and diversity, is now gaining attention for its recent legislation, prompting some residents to reconsider their residency. Explore the new laws of 2024 and the controversies and migration they’re stirring. California’s 16 New Laws Raise Red Flags for Prospective Residents

The post Biden’s Bold Plan Is to Tax the Rich to Rescue Social Security and Medicare first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / lev radin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.