Historically, tariffs have proven ineffective in achieving many economic benefits. However, this hasn’t stopped the Biden administration from recently raising tariffs on the import of Chinese electric vehicles. The impacts of this decision will be important for consumers, businesses, and the environment.

New U.S. Tariffs on Chinese Imports

Last month, U.S. President Joe Biden announced a series of new tariffs on Chinese imports, like solar panels, batteries, and most surprisingly, electric vehicles (EVs). The government has doubled the import tax on Chinese solar panels and semiconductors.

Electric Vehicles Hit the Hardest

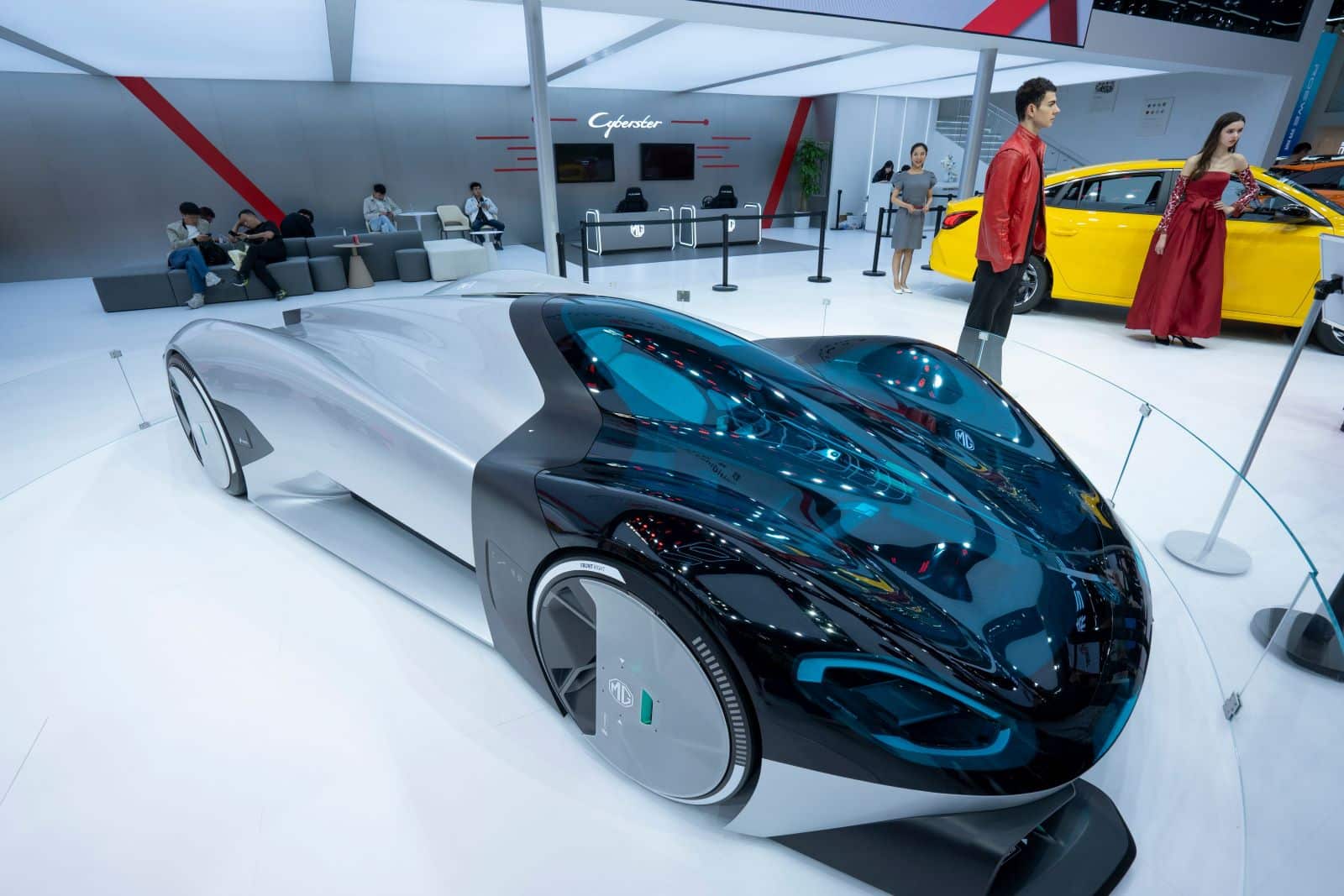

The standout decision in this announcement is the choice to raise tariffs on Chinese electric vehicles from 25% to 100%. This quadruple increase likely reflects the growing purchasing power within the industry.

Policy Intent

The White House clarified that this tariff is meant to protect the industry from the pressure of unfair international competition. The administration claims that Chinese firms have an advantage from their governmental subsidies, and experts belive Chinese imports could compromise Biden’s investments in the EV industry.

Consumer Demand

There is a strong and growing demand for EVs around the world, driven by policies promoting green energy and environmental concerns. Even with the tariffs, the demand for affordable and efficient Chinese EVs may remain strong.

How the Industry has Developed

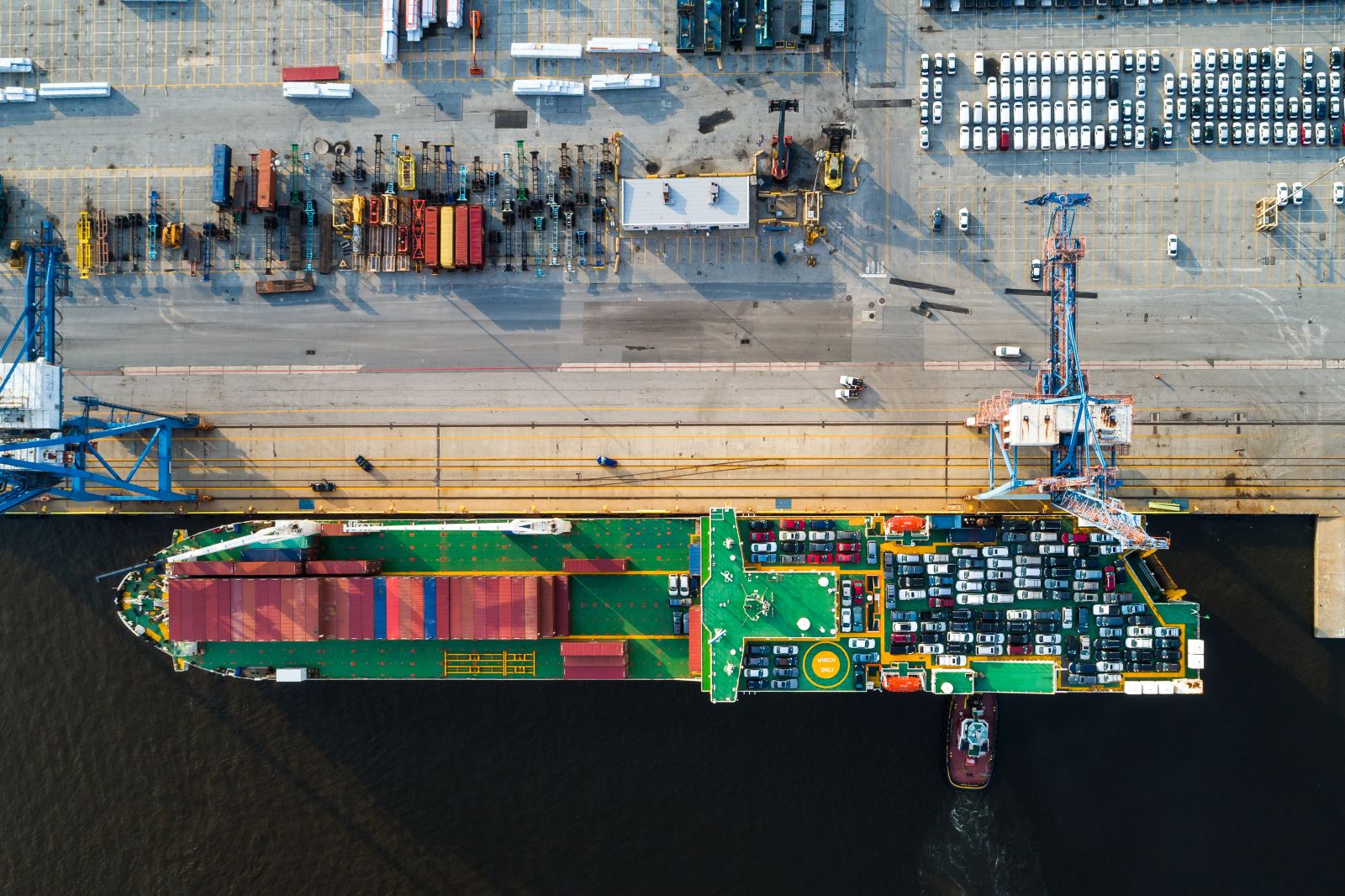

40 years ago, China was hardly even a contender in the global auto industry. Now, however, the country is producing enough cars to supply half of the world, meaning the country is looking to export large quantities, at a likely lower price than domestic markets can offer.

U.S. History of Tariffs

The U.S. is not well-known for its effective tariffs. In fact, most historical tariffs, like Bush’s attempt to tax steel in 2002 and Obama’s solar panel tariffs have done more harm than good, costing American jobs and import possibilities, and raising prices.

European Tariffs

The U.S. is not the only administration imposing tariffs, as the European Union also announced an increase of tariffs on Chinese EVs. This decision has similar motivations, as leaders hope that these efforts will strengthen domestic automotive markets.

Impact on Chinese Manufacturers

In the short-term, Chinese exporters will face higher costs for selling their EVs into the U.S. market, which could neutralize their competitive edge. Chinese companies might respond by focusing more on other regions in order to relieve the impact of the tariffs.

The U.S. Market

U.S. consumers and businesses are likely to face higher prices due to the reduced competition and increased importation costs. On the other hand, the tariffs lead to greater investment in the U.S. market, potentially leading to job creation and technological advancements.

The Tariff Could Defy Trends

Experts are currently debating whether or not this tariff announcement will help or hurt the U.S. market. Let’s first explore what positives experts are foreseeing.

Strategic Timing

It’s possible that the time of these tariffs is more ideal compared to past efforts. With increasing global demand for renewable energy and strong global push for EV creation and advancements, the tariffs could come at a critical time.

Market Shift

The desire to lower our global carbon emissions means that the U.S. EV market is growing. The tariffs could be a strong push for the domestic production of these vehicles and for advances in related technology, which could encourage investment in U.S. markets.

Domestic Industry Boost

The taxes could give the domestic industry a boost by diversifying the supply chains away from China. This might encourage investments in other manufacturing areas and create more jobs in the domestic industries.

Safety Motivations

This tariff reflets more than purely financial or even political motivations. Some U.S. officials are concerned about the cybersecurity threat of Chinese software being used in Chinese-made EVs, which could be relieved by the tariff.

How the Tariff May Create More Problems

Along with the potential benefits are theoretical negative consequences. Some experts are predicting that the tariffs will not have their intended positive effects.

Higher Consumer Costs

As with most tariffs, U.S. consumers will bear the initial costs of the price increases. Reduce competition and increased import costs will surely be felt by consumers in the beginning.

Trade War Escalation

U.S.-Chinese relations are already strained. This decision has the risk of escalating the already existing trade tensions. China may choose to impose retaliatory tariffs on U.S. goods, affecting other areas of the economy.

Global Supply Chain Effects

Global supply chains are already very intertwined amongst countries. Increasing tariffs might disrupt the production processes in China and other countries involved in the production of EVs and the manufacturing parts that go along with them.

Effect on Environmental Goals

Recent tariffs have been aimed toward products within the sustainability field. These taxes may limit the availability of affordable EVs and counteract the ambitious environmental goals that many countries have set.

Technological Advancements for Many

Chinese companies are rapidly advancing their available EV technology to remain competitive. Despite the outcome of the tariffs, many countries are bound to explore new technology to remain competitive in the changing market.

Moving Forward

Only the future will tell exactly how tariffs impact the EV industry, and other associated manufacturing industries, in the long-run. For now, it seems the U.S. hopes to positively influence U.S. industries and their international competitiveness.

23 Steep Taxes Adding to California Residents’ Burden

Image Credit: Shutterstock / Alex Millauer

Image Credit: Shutterstock / Alex Millauer

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Image Credit: Shutterstock / Kostikova Natalia

Image Credit: Shutterstock / Kostikova Natalia

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, these items have become valued objects, and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Image Credit: Shutterstock / mariakray

Image Credit: Shutterstock / mariakray

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

The post Biden Jacks Up Tariffs on Chinese EVs by 100%, Sending Shockwaves first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Tada Images.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.