Critics of President Biden’s economic policies, often referred to as ‘Bidenomics,’ suggest that the current administration’s policy decisions and approaches are detrimental to the nation’s economic growth and development. Here are 21 key areas where critics suggest Biden’s policies fall short.

#1. Slow Wage Increases

Under Bidenomics, wage growth has remained sluggish despite promises of boosting the economy. And even though employment rates have improved, the average American worker has not seen a sufficient increase in their paycheck to counter the increasing financial strain.

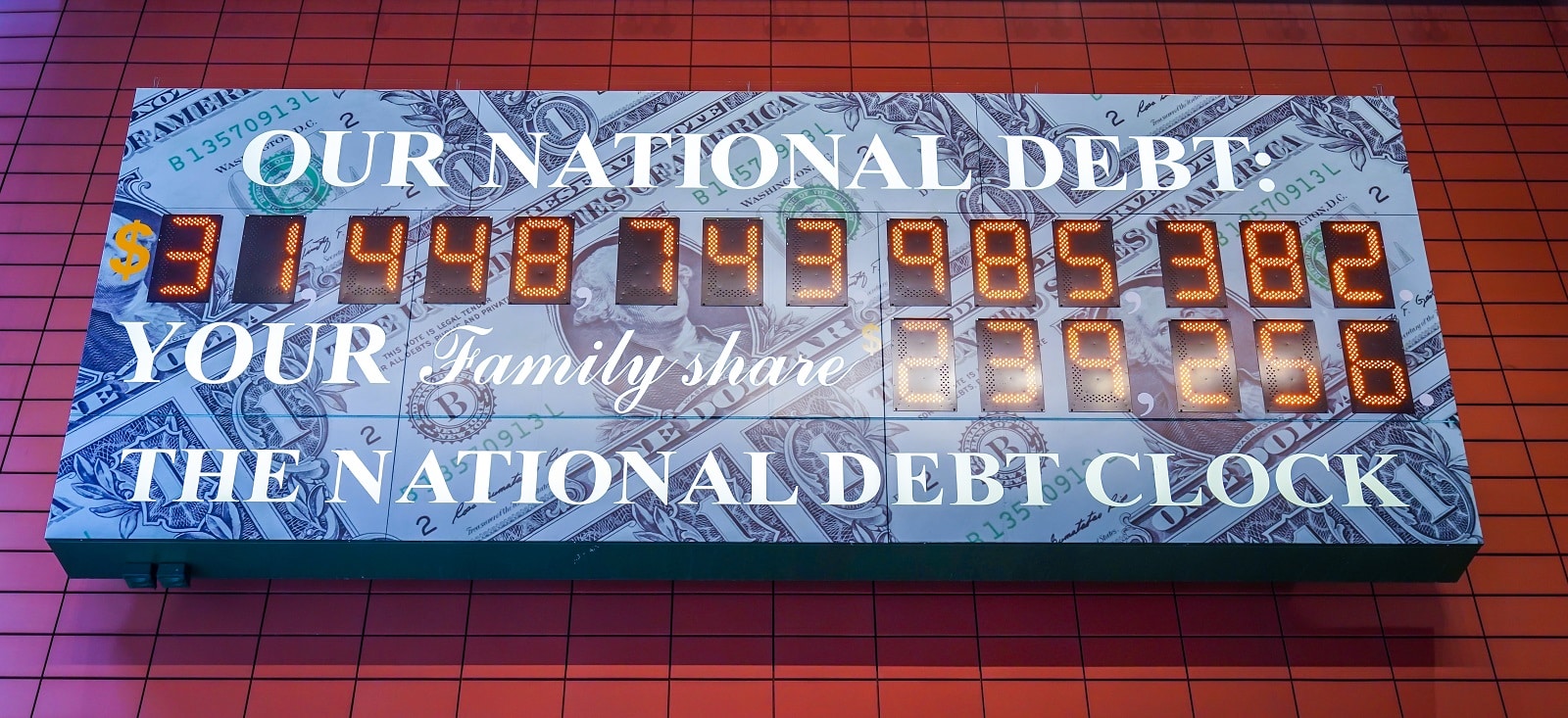

#2. $33 Trillion Surge In National Debt

The national debt has significantly increased under Bidenomics, exceeding $33 trillion as of September 15, 2023. This rapid increase, including a half-trillion-dollar surge, generates doubts among critics about the sustainability of Biden’s fiscal policies and places an undue burden on American taxpayers.

#3. Rising Inflation Rates

The cumulative inflation rate exceeded 17.1% under Biden’s economic policies, drastically affecting the cost of living for American families. This considerable inflation has led to increased prices for groceries, gas, housing, and other household goods, with families paying $15,133 more annually than in 2021.

#4. Lack of Small Business Support

Small businesses, a crucial part of the American economy, have reported a decline in confidence. Many entrepreneurs feel that current policies do not support their growth, thereby stifling innovation and job creation.

#5. Missed International Trade Opportunities

Critics argue that Bidenomics lacks a strong international trade strategy, resulting in missed opportunities for American businesses, potentially weakening the United States’ position in the global market.

#6. Failure to Address Wealth Inequality

Tax policies under Bidenomics have been criticized for not effectively addressing wealth inequality. Instead, they are perceived as burdensome to middle-class families and small business owners.

#7. Skyrocketing Cost of Living

The cost of living crisis is evident, with a Bank of America survey in September finding that 67% of employees say the cost of living is outpacing growth in their salary and wages. Higher fuel, food, housing, and healthcare costs create a financial situation that the average American struggles to sustain.

#8. Slow Economic Recovery Post-COVID

The expected economic recovery following the COVID-19 pandemic has been slower than anticipated under Biden’s leadership. Critics attribute the delay to the administration’s economic policies, which they argue have not adequately stimulated growth.

#9. Volatile Stock Market

The stock market has experienced increased volatility and uncertainty, attributed partly to the economic policies and regulatory environment under Bidenomics. During Biden’s presidency, the stock market saw significant fluctuations. Despite strong performances in 2021 and 2023, 2022 was marked by a notable downturn, with the S&P 500 experiencing a 25% drop at its lowest point, entering bear market territory.

#10. Spiking Energy Prices

In August, energy inflation spiked as high as 5.6% due to high crude oil prices, causing gasoline prices to rise significantly. Bidenomics has faced criticism for its approach to the energy sector, particularly in terms of balancing environmental goals with economic realities.

#11. Spiralling Healthcare Affordability

72% of Americans struggle to afford rising healthcare costs. Despite Biden’s efforts to improve healthcare, affordability remains a significant challenge for many Americans. Critics point to a lack of effective measures in Bidenomics to reduce healthcare costs.

#12. Failure to Deliver Infrastructure Development

Infrastructure development, a key promise of President Biden, has been slow and underwhelming. Biden has faced criticism for several issues: unfinished high-speed rail plans, persistent supply chain problems and high prices, potential delays in infrastructure projects, defense of the controversial California High-Speed Rail, and low approval ratings amid economic concerns.

#13. Education System Failure

Biden’s adherence to the traditional education system, despite criticism, disappointed many. He neglected calls for a child-centric system and missed a chance to collaborate with Republicans on enhancing educational opportunities. Instead, he increased regulations on charter schools, limiting their growth, and failed to prioritize the needs of parents, students, and families in education.

#14. Agricultural Sector Neglect

The agricultural sector, vital to the American economy, feels neglected under current policies. Issues like trade policies, environmental regulations, and financial support remain inadequately addressed. In particular, President Biden’s lack of action on free-trade agreements allows competitors to gain advantages.

The administration’s focus on eliminating non-tariff barriers has been ineffective. Mexico’s biotech corn ban and Brazil’s ethanol tariffs have hurt American farmers, and the administration’s responses have been insufficient.

#15. Labor Market Shortage

There is a growing disconnect between available jobs and skilled labor, partly attributed to the administration’s economic policies. This mismatch hinders economic growth and job satisfaction.

The November unemployment rate of 3.7 percent is just 0.2 percentage points above its pre-pandemic level, which marked a five-decade-low in joblessness.

#16. Housing Market Affordability Crushing American Dreams

The housing market has experienced instability, with rising prices and affordability issues. Critics believe Bidenomics has not effectively tackled these challenges, impacting the homeownership dream of many.

Under Biden’s presidency, the median home price has surged by over 27%, and mortgage interest rates have increased from 2.8% to 7.2%. Consequently, the monthly payment for a median-priced home has more than doubled, escalating from $979 to $2,075.

#17. Diminished Consumer Confidence

A striking dip in consumer confidence reveals a deeper concern about the economy’s direction under Bidenomics. Consumers continue to be hesitant despite unemployment sitting close to a 50-year low, stock markets are soaring, and the wider economy remains resilient.

#18. Overregulation of Industries

Some industries complain of overregulation, which they argue stifles innovation and growth. In particular, the Automotive, energy, and agricultural industries have faced numerous changes and regulatory shifts.

Critics of Bidenomics believe a more balanced approach is needed to encourage economic development.

#19. Failure to Support Technological Advancement

Critics of ‘Bidenomics’ argue that there is a notable lack of support for technological advancement under Biden’s leadership, a critical driver of future economic competitiveness.

The worry is that without robust investment and strategic initiatives, the U.S. may fall behind in crucial areas such as artificial intelligence, biotechnology, and clean energy, jeopardizing its economic prospects and global influence in the tech industry.

#20. Lack of Resilience in the Face of Global Economic Uncertainties

The government’s actions have made the world’s economy more uncertain, and critics worry about America’s economic resilience and capacity to navigate international challenges.

The situation is exacerbated by developing trade problems and the ongoing pandemic, which can hurt the economy and trade with other countries. Critics are concerned that the policies may not offer sufficient safeguards or strategic direction, making them unsure if the U.S. can stay strong in the world economy.

#21. Economic Benefits Not Evenly Realized

Finally, there is a perception that the benefits of Bidenomics are not evenly distributed, with some regions and sectors feeling left behind. This uneven impact raises questions about the overall effectiveness of Biden’s policies in supporting the diverse American economy.

The post Critiquing Bidenomics: 21 Issues Exposed first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / lev radin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.