Revisions to federal plans to forgive student loans could have a major impact on millions of Americans.

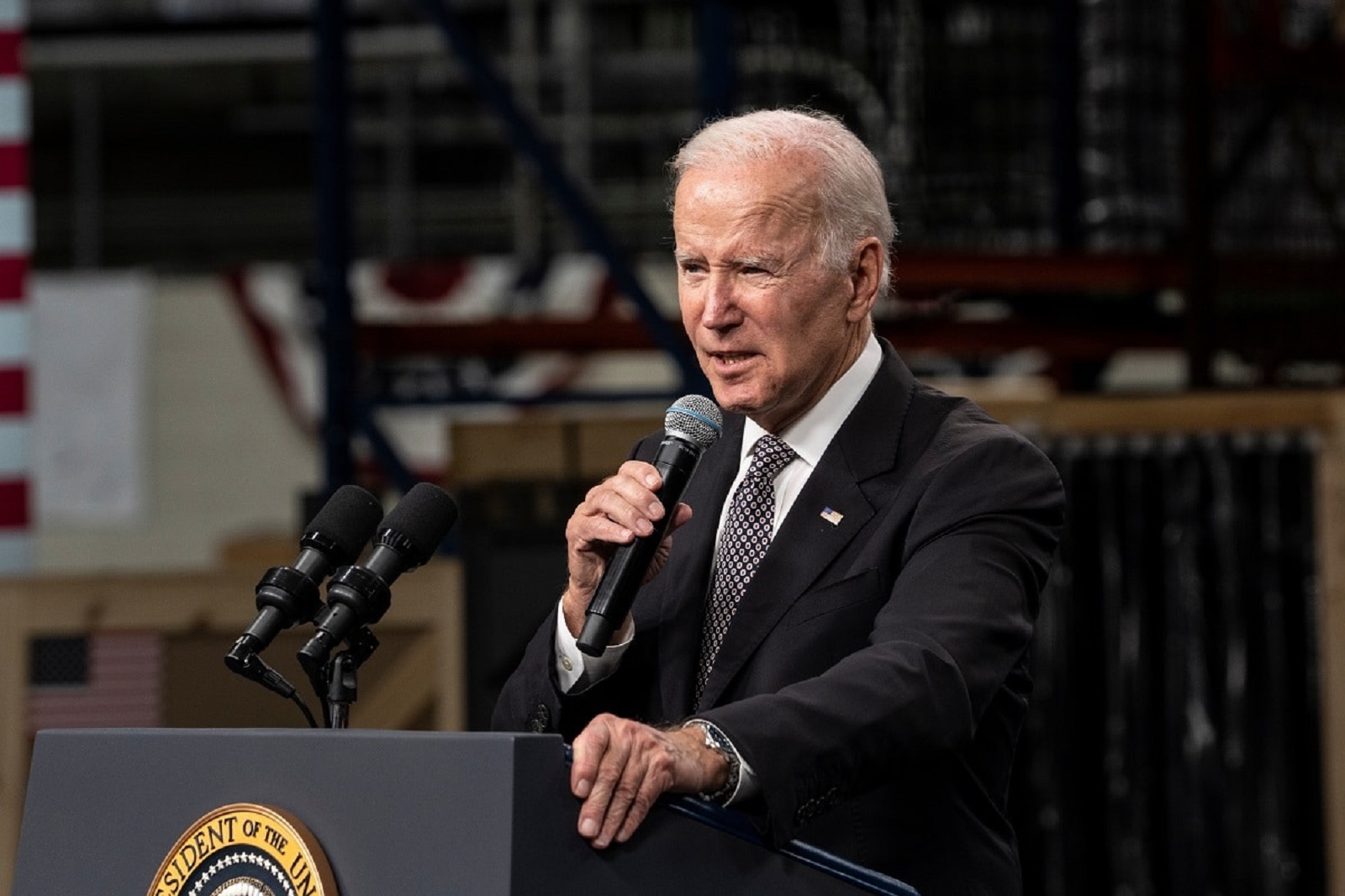

President Looks to “Plan B” to Fight Student Debt

After the Supreme Court rejected President Biden’s $400 billion plan to forgive student loans for millions of borrowers, the administration has announced what they’re calling “Plan B” — a new initiative that hopes to provide relief to certain student loan account holders.

Program Aims to Help Struggling Borrowers

Despite no guarantee that it will survive the legal process, the program is optimistic that it will positively impact Americans who are struggling financially with the burden of paying their student loan payments.

“Financial Hardship” a Qualifying Factor for Relief

The revised plan could provide relief to borrowers who are currently in the midst of financial hardship, but at this time, there has not been any clarity about what exactly that means.

Defining Hardship

There are speculations that people struggling with medical debt or childcare could qualify for Plan B forgiveness.

Decades-Old Accounts Could Be Forgiven

Plan B also aims to forgive student debt for people who have already been making payments on their student loans for at least twenty years.

“Schools of Questionable Quality”

Students who attended “schools of questionable quality” could also receive debt cancellation. The administration specifically called out educational programs “that created unreasonable debt loads or provided insufficient earnings for graduates.”

Potential Beneficiaries

Other potential beneficiaries of the Plan B rollout include borrowers who are already eligible for forgiveness under another plan but have not yet applied for it and people whose balances are currently higher than what they originally borrowed due to high-interest rates.

Plan B Could Be Better Received

Legal experts feel confident that Plan B will have an easier time making it through legal hurdles than the original attempt. Since the revised plan would apply to far fewer borrowers, the hope is that the courts will be less concerned about a sweeping federal move.

The Higher Education Act of 1965

Plan B looks to the Higher Education Act of 1965, which provides some authority to forgive student debt, to back up its initiative.

A Failed Pandemic Relief Plan

Biden’s first attempt at student debt forgiveness used the Heroes Act of 2003 as evidence that he had the authority to cancel loans for some 40 million borrowers, but the Supreme Court shot that down.

The Heroes’ Act of 2003

The Heroes’ Act of 2003 was established after 9/11 as a measure to legally forgive or pause student debt payments in the event of a qualified national emergency.

The Biden administration hoped to use the COVID-19 pandemic to justify canceling the debt.

Pandemic Was Not a Valid Reason to Cancel Debt, Said Supreme Court

In the decision from the Supreme Court, Chief Justice John Roberts said that because the pandemic was no longer in full swing, it wasn’t a good reason to cancel student debt.

“We Can’t Believe the Answer Would Be Yes”

“Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?” Roberts asked. “We can’t believe the answer would be yes.”

Adjusting Interest

In addition to the plan to forgive student debt, the administration hopes to place a cap on interest rates and forgive up to $20,000 in unpaid interest for borrowers who hold federal student loans.

Balances Exceeding Initial Borrowed Amounts

Because of astronomical interest rates, many student loan borrowers face higher balances than they started despite spending years making on-time payments. This is one of the issues that Plan B hopes to address.

A Political Game

Student loan forgiveness has been a hot-button topic in this election cycle, but Americans struggling under the weight of their student loan payments are just hoping for relief.

The Real People Impacted

While it is a political issue for presidential hopefuls, it is a matter of survival for low-income families who are having trouble making ends meet.

Fighting Among Politicians

Biden continues to point fingers at his Republican colleagues, whose opposition to his forgiveness plans has brought them to a halt.

“Tens of Millions of People’s Debt Was Literally About to Get Canceled”

“Tens of millions of people’s debt was literally about to get canceled, but then some of my Republican friends…sued us, and the Supreme Court blocked us,” the president said.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, they items have become valued objects and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

Featured Image Credit: Shutterstock / lev radin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.