Struggling Americans Desperate

Inflation, stagnant wages, and income uncertainty have driven many Americans to the point of desperation. Leaning on credit cards to keep their households afloat, some people are finding it difficult to keep up with their payments due to a vicious cycle of high interest rates and growing expenses.

Credit Scores Have Trended Up for a Decade

Over the past decade, credit scores have trended upward as families recovered from a recession and enjoyed a stable economy.

More People Struggle with Bills

Now that money troubles are plaguing more people, even those who were previously comfortable, credit card payments are dipping lower on the priority list.

Having to focus first on paying historically high housing payments and food costs, many are struggling to pay their credit card bills on time.

Americans Have $1 Trillion in Credit Card Debt

A recent report from the Federal Reserve Bank of New York showed a staggering increase in credit card debt in the country, revealing a new total of over $1 trillion.

Average Credit Score Dropped 1 Point

FICO said that in addition to the record-breaking credit card debts, the average American’s credit score dropped by a point last year. This average has not decreased in a decade.

Economic Issues “Starting to Weigh on Consumers”

“The effects of high-interest rates and persistent inflation may be starting to weigh on consumers, especially those already struggling to manage their finances,” said FICO’s Can Arkali in their report.

Late Payments to Blame for Drop

Experts agree that financial duress resulting in the inability to make on-time payments is the driving factor behind the decreased average credit score.

And since the COVID-era financial relief many families were relying on has ended, people are finding it challenging to keep up.

Credit Cards Used for Necessities, Not Luxuries

For struggling Americans, credit cards are more likely to be used to pay an overdue electricity bill or purchase groceries than to engage in an online shopping spree.

Many times, credit card debt is accumulated out of necessity and not irresponsibility.

A “Financial Strain”

“The apparent cumulative impact of higher interest rates, elevated consumer prices, and economic uncertainty has put a financial strain, especially on those consumers who heavily rely on credit cards to cover everyday expenses,” Arkali continued.

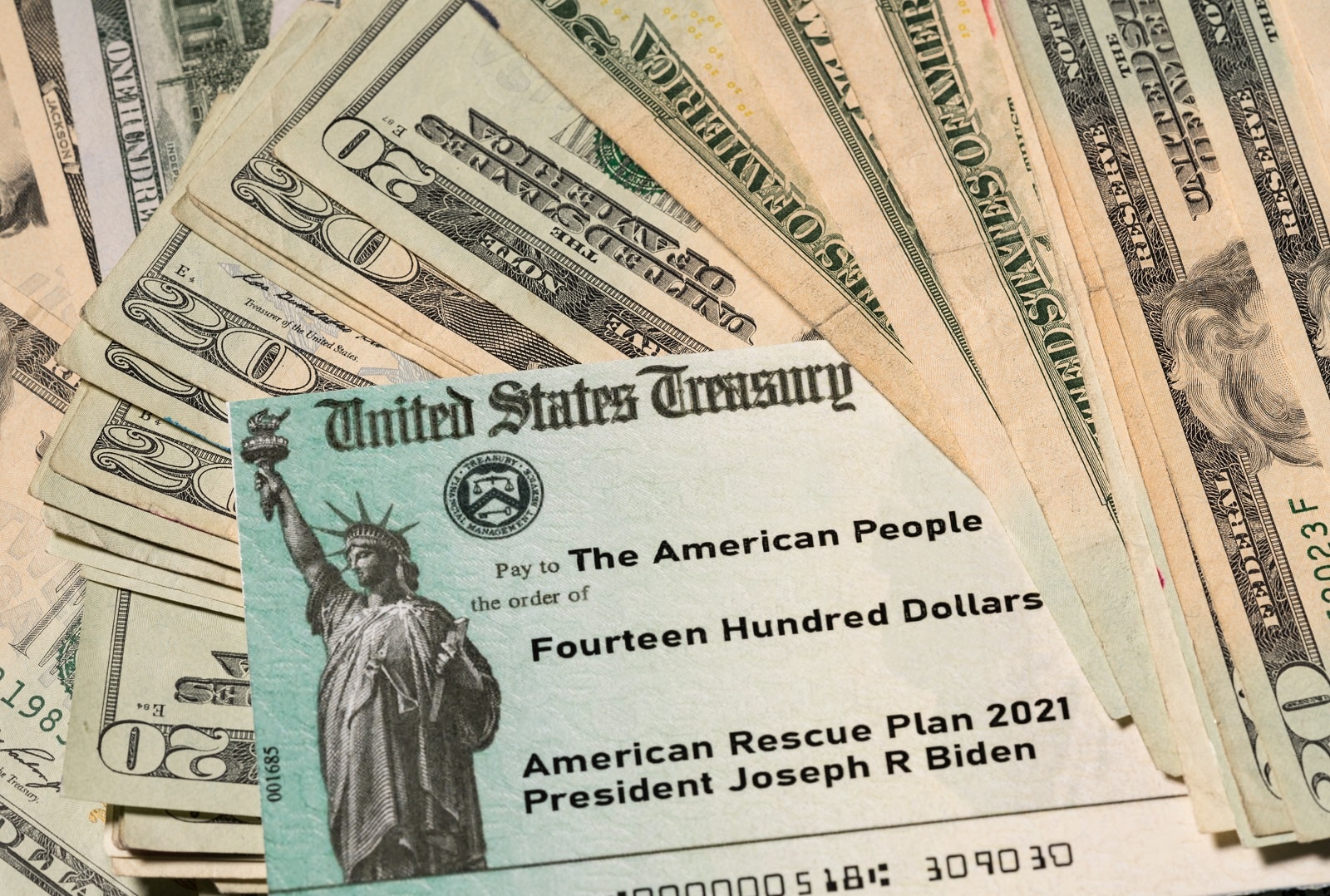

COVID Did Not Decrease Credit Scores

Even during the COVID-19 pandemic, credit scores kept increasing despite the fact that millions of people struggled financially.

Relief from the government and payment pauses from lenders provided a buffer to many Americans.

Lenders Offered Assistance During Pandemic

Some banks, credit unions, and other lenders offered forbearance programs during the pandemic to help struggling borrowers stay current.

Student loan payments backed by the government were paused, and stimulus checks went out to most taxpayers.

The Cycle of Missed Payments

People who miss their payments begin to experience a cyclical issue. Their debt increases as more interest and late fees are applied, and their credit score drops as a result.

Interest Rates May Increase as Scores Drop

As credit scores drop, credit card companies take notice and may increase the already astronomical interest rates on account. This contributes to the underlying issue and makes it even harder for borrowers to pay off their debt.

Advice for New Borrowers

For those who are new to credit, experts recommend making every effort to make payments on time and keeping credit utilization low to protect and boost their credit scores.

Consult Your Credit Card Company

If you can’t make your payments, it’s a good idea to contact the credit card company directly. Many have hardship programs in place that can reduce or even pause payments for customers who qualify for help.

Hardship Programs for Eligible Borrowers

Those programs protect your credit score and are preferable to missing payments. For every 30 days your payments are late, your credit is likely to take hits.

Consolidation Loans

Others struggling with low credit scores and high credit card balances may want to look into consolidation loans, which can help reduce the overall monthly payment and interest rate.

Unemployment Rate Increased in February

Reports show that in February, the unemployment rate jumped to 3.9%, which was higher than experts predicted.

This is a concerning figure, especially amidst reports that most unemployed people are actively looking for gainful employment.

New Jobs Exceeded Expectations

In better news, the number of new jobs added in February was also underestimated – a total of 275,000 jobs were added instead of the expected 198,000.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, they items have become valued objects and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

10 Reasons Firearms Are Essential to America’s Fabric

Americans’ strong attachment to guns is influenced by constitutional rights, historical context, and cultural traditions. This article explores the cultural perspective driving their unwavering support for gun ownership, revealing the key factors shaping this enduring aspect of American life. 10 Reasons Firearms Are Essential to America’s Fabric

California’s 16 New Laws Raise Red Flags for Prospective Residents

California, celebrated for its beaches, tech prowess, and diversity, is now gaining attention for its recent legislation, prompting some residents to reconsider their residency. Explore the new laws of 2024 and the controversies and migration they’re stirring. California’s 16 New Laws Raise Red Flags for Prospective Residents

The post Debt Crisis Hits Hard: Americans Endure Credit Score Catastrophe first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Alina Nikitaeva.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.