Homebuyers and real estate investors be warned - record-high debt in the U.S. may send interest rates skyrocketing in the coming year.

A 7% Rise in Interest Rates

Leading financial experts predict that if immediate action isn’t taken, the U.S. record-high debt may cause interest rates to rise to 7% in the coming year.

Experts 2025 Prediction

According to Joao Gomes, a finance professor at the Wharton School of the University of Pennsylvania, America’s $34 trillion debt could potentially lead to a crisis that could raise interest rates above 7% in 2025.

Government Must Take Action

The possibility of a jump in interest rates is likely if the U.S. government fails to take action on its record-high debt in time.

No Plan, No Motivation

But Gomes and other industry professionals have suggested that high-ranking officials with the power to make these changes either are not politically motivated to tackle the issue or they haven’t figured out the right strategies to do so.

Focusing On the Wrong Issues

While many people in the U.S. are focused on the likely repeat political showdown between President Biden and former President Trump, Gomes has claimed that regardless of who is in power, the next administration must focus on avoiding an imminent debt crisis.

“Could Derail the Next Administration”

“It could derail the next administration, frankly,” he said in an interview with the business and finance publication Fortune magazine.

A Confident Prediction

He also asserted that he was “very confident” that the U.S. would experience a major debt crisis by the end of the decade.

“We Could Have a Crisis in 2025”

“If they come up with plans for large tax cuts or another big fiscal stimulus, the markets could rebel, interest rates could just spike right there, and we would have a crisis in 2025,” he elaborated.

“I’m very confident by the end of the decade one way or another, we will be there.”

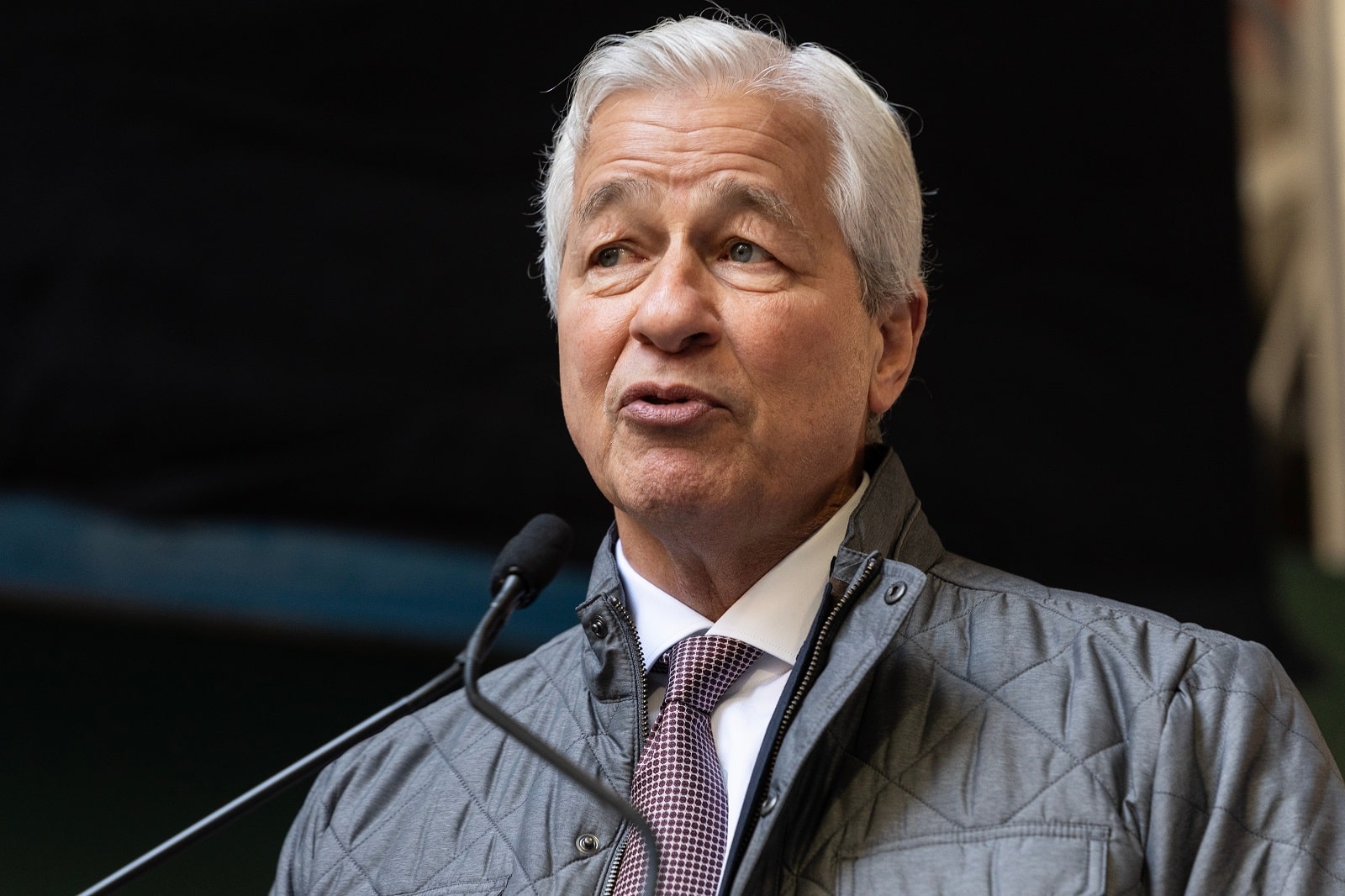

Other Experts Weigh In

Jamie Dimon, the CEO of JPMorgan Chase & Co., and Federal Reserve Chairman Jerome Powell have both publically expressed their fears about the impact that U.S. debt will have on the economy.

Global Market Rebellion

Back in February, Dimon announced that Washington was facing a “global market rebellion” due to mounting debt rates.

Accusations Fly

Powell, in an interview with 60 Minutes, accused the U.S. government of “borrowing from future generations” and called for an “adult conversation” about debt and its fiscal unsustainability.

An Adult Conversation

“It’s time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path,” he said.

“A Debt Spiral”

Controversial mathematician, risk analyst, and author of The Black Swan Nassim Taleb also made headlines in January for claiming that the US faced a “debt spiral” due to growing debt.

A Worry for the Property Market

These predictions should be especially concerning to homebuyers and real estate investors. The current lack of inventory and ever-increasing property prices have already reduced the average American’s purchasing power.

Locking Millions Out

On top of these pre-existing issues, an additional 7% rise in interest rates could lock millions of Americans out of the property market for good.

Public Spending, Investor Faith

What’s more, it could harm public spending and reduce faith in America’s economy and ability to repay its debts.

Particularly Concerned

But while these warnings may seem like a cause for panic, not everyone believes that the situation is as dire as Gomes has posited, something that the professor himself has acknowledged.

Time to Ask Tougher Questions

“I probably worry about U.S. debt more than most of my colleagues,” he shared on social media. “But in this election year, I believe voters should ask much tougher questions of politicians that don’t take this threat seriously.”

Voters Take Notice

And while some politicians may avoid the question of rising national debt and its consequences, the average voter is not.

Rising Concerns

According to a 2023 survey from the Pew Research Center, 57% of Americans believe that “reducing government debt” is a key concern for the nation’s future.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, they items have become valued objects and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

10 Reasons Firearms Are Essential to America’s Fabric

Americans’ strong attachment to guns is influenced by constitutional rights, historical context, and cultural traditions. This article explores the cultural perspective driving their unwavering support for gun ownership, revealing the key factors shaping this enduring aspect of American life. 10 Reasons Firearms Are Essential to America’s Fabric

California’s 16 New Laws Raise Red Flags for Prospective Residents

California, celebrated for its beaches, tech prowess, and diversity, is now gaining attention for its recent legislation, prompting some residents to reconsider their residency. Explore the new laws of 2024 and the controversies and migration they’re stirring. California’s 16 New Laws Raise Red Flags for Prospective Residents

The post Debt Crisis Threatens to Raise Rates to 7% by 2025 first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Rainer Fuhrmann.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.