Understanding tax credits can be incredibly complex, yet to ensure one can benefit from all that is available it is crucial to know what opportunities lie within the U.S. tax system.

Understanding Tax Credits

Tax credits are not mere deductions; they are even more valuable. As Eric Bronnenkant, head of tax at Betterment, states, “This is an area of confusion.” Unlike deductions that reduce taxable income on which you then pay tax, tax credits directly decrease the amount of taxes you owe, dollar for dollar.

The Power of Refundable Credits

Some tax credits are refundable. This means if the credit exceeds your tax liability, you get the difference as a refund. Nonrefundable credits can only reduce a tax bill to zero. These credits, therefore, offer a significant financial advantage to eligible taxpayers.

Eligibility and Restrictions

The government imposes strict eligibility criteria for these credits, often based on income or specific personal circumstances. Understanding these requirements is key to determining which credits you can claim.

Discovering Your Eligible Credits

Life changes such as having a child or starting college might open the door to new tax credits. Utilizing tools like tax organizers or software can help identify these opportunities.

Education-Related Credits

For those bearing the costs of higher education, credits like the American opportunity credit and lifetime learning credit offer substantial relief. The former provides up to $2,500 per student, while the latter can grant a $2,000 credit annually.

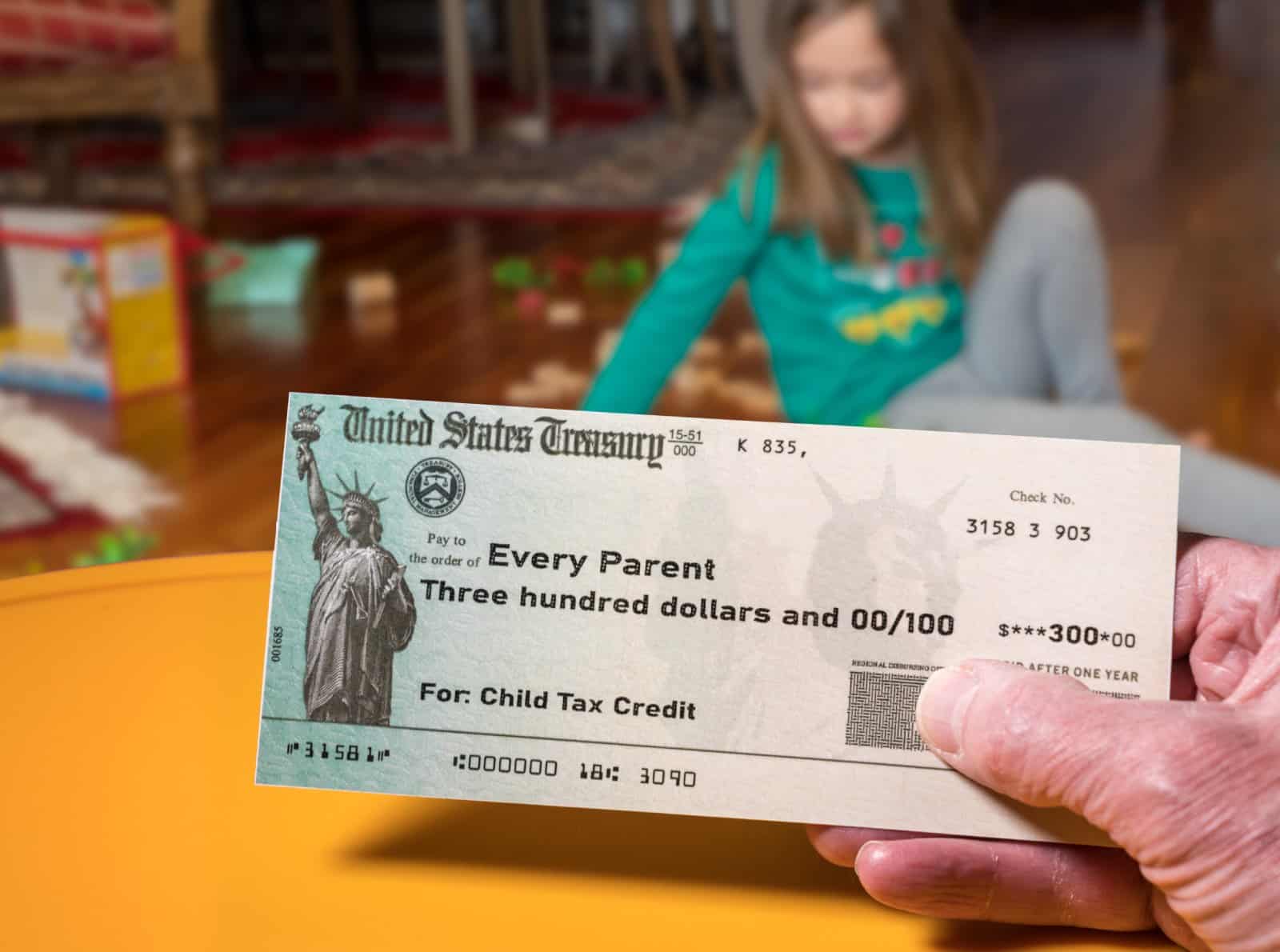

Families and Tax Credits

The child tax credit is a common benefit for families, offering up to $2,000 per child. There’s also the child and dependent care tax credit, aiding those who pay for child care.

Assisting Adoptive Parents

The adoption credit is a boon for parents going through the adoption process, offering up to $15,950 per child to offset legal and other adoption-related expenses.

Aid for Low-Income Households

The earned income tax credit provides substantial assistance for low-income families, particularly those with children. The credit can be particularly valuable at several thousand dollars.

Healthcare Subsidies

Under the Affordable Care Act, the premium tax credit helps lower-income families afford health insurance. This refundable credit is adjusted based on income and insurance costs.

Encouraging Green Investments

Credits for energy-efficient home improvements and clean energy installations incentivize eco-friendly home upgrades. These credits cover a portion of costs for items like energy-efficient windows and solar panels.

Global Income Considerations

The foreign tax credit offers relief to those who pay taxes on foreign income, a scenario common for American citizens living abroad or those with foreign investments.

Saving for Retirement

The retirement savings contribution credit encourages retirement savings by offering a credit for contributions to IRAs and employer-sponsored plans, based on income.

The Impact of Tax Credits

Tax credits have a profound impact on reducing tax liabilities. They provide financial relief across various life situations, from raising children to investing in education and retirement.

Choosing the Right Credits

Determining the best tax credits for your situation requires a thorough understanding of each credit’s eligibility criteria and benefits. Accurate identification and claiming of credits can lead to significant tax savings.

Avoiding Common Misconceptions

It’s essential to distinguish between tax credits and deductions. Logan Allec, CPA and owner of Choice Tax Relief, clarifies, “A tax credit is a dollar-for-dollar reduction in one’s tax liability.”

Preparing for Tax Season

Proper preparation for tax season involves not only understanding your eligibility but also organizing your financial information to ensure you claim all applicable credits.

Complex Tax Laws

The complexity of tax laws can be daunting. Seeking professional advice or using reliable tax software can be instrumental in navigating this complexity and maximizing your tax benefits.

Long-term Financial Planning

Tax credits should be considered a part of your broader financial strategy. Understanding how they fit into your long-term financial planning can lead to better financial health and stability.

Embracing Opportunities for Savings

Tax credits present an opportunity to reduce tax liabilities and potentially receive refunds. Embracing these opportunities requires staying informed and proactive about your tax situation.

Vital Financial Management

Tax credits are a vital aspect of financial management. By understanding and utilizing these credits, taxpayers can significantly reduce their tax burden and enhance their financial well-being.

The post Claim What’s Yours: Get to Know Your 2024 Tax Credits first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.