Are you ready to take your financial growth to the next level? Doubling your income in a year might seem like a daunting task, but with the right strategies and determination, it’s entirely achievable. Whether you’re looking to boost your salary, start a side business, or invest for higher returns, this listicle provides 16 proven strategies backed by facts, figures, and real-world examples to help you double your income in the next twelve months.

Invest in Education and Skill Development

Education is a powerful tool for increasing earning potential. Consider pursuing further education or acquiring new skills relevant to your industry.

According to the U.S. Bureau of Labor Statistics, individuals with higher levels of education tend to earn higher salaries.

For example, completing a certification course or obtaining an advanced degree can lead to significant salary increases or career advancement opportunities.

Negotiate a Raise or Promotion

Don’t be afraid to advocate for yourself in the workplace. Research industry standards and present a compelling case for your value to the company.

According to a study by PayScale, employees who negotiate their salary can increase their earnings by an average of $5,000 or more per year.

You can substantially boost your income by negotiating a higher salary or promotion.

Start a Side Business

Launching a side business can provide an additional source of income beyond your primary job.

According to a report by Bankrate, 45% of Americans have a side hustle, with the average extra income amounting to $8,794 per year.

Consider starting a side business such as an e-commerce store, consulting service, or freelance gig to supplement your earnings.

Monetize Your Hobbies or Talents

Leverage your passions and talents to generate income. The global market for creative goods and services is estimated to reach $2.2 trillion by 2025, offering ample opportunities for monetization.

Artists, writers, musicians, and other creatives can sell their work online through platforms like Etsy, Patreon, or freelance marketplaces.

Invest in the Stock Market or Real Estate

Investing can be a powerful wealth-building tool. Historically, the stock market has provided an average annual return of around 7% to 10%, while real estate investments can generate rental income and appreciation over time.

Consider investing in diversified index funds, rental properties, or real estate investment trusts (REITs) to grow your wealth.

Seek Higher-Paying Opportunities

Explore job opportunities in high-demand fields or industries with competitive salaries. Glassdoor reports that switching jobs can lead to an average salary increase of 10% to 20%, depending on the industry and location.

Consider advancing your career or seeking higher-paying positions to boost your earning potential.

Create and Sell Products or Services

Entrepreneurship offers opportunities for income generation. The global e-commerce market is projected to surpass $6.3 trillion by 2024, providing entrepreneurs with lucrative opportunities to launch and scale online businesses.

Consider selling digital products, physical goods, or services online through platforms like Shopify, Amazon, or Upwork.

Optimize Your Current Income Streams

Maximize your current income streams by optimizing your operations. According to McKinsey, businesses that optimize their operations can increase their profits by up to 20%.

Streamline workflows, reduce overhead costs, and implement efficiency improvements to enhance profitability and maximize your income.

Network and Collaborate

Build strong professional relationships and collaborate with industry peers to expand your opportunities.

A study by Harvard Business Review found that up to 85% of job opportunities are filled through networking.

Networking can lead to new clients, partnerships, and lucrative projects that contribute to income growth.

Set Clear Financial Goals and Take Action

Define specific income targets, create a detailed action plan, and track your progress regularly.

Research from the Dominican University of California shows that individuals who write down their goals are 42% more likely to achieve them.

By setting clear financial goals and taking consistent action, you can stay focused and motivated on your journey to doubling your income.

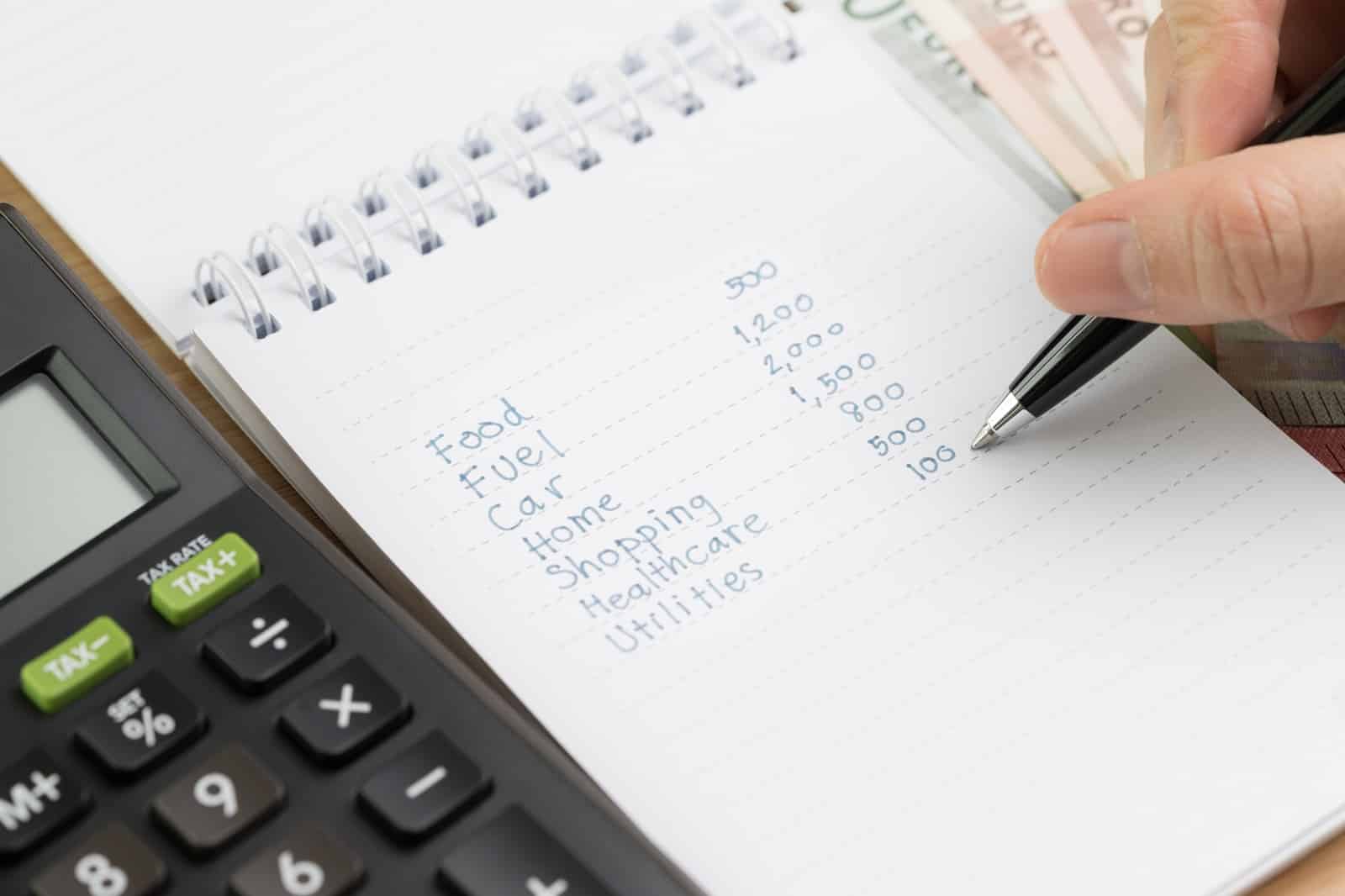

Track Your Expenses and Identify Savings Opportunities

Start by meticulously tracking your expenses to understand where your money is going. Use budgeting tools or apps to monitor your spending habits and identify areas where you can cut back.

According to a survey by the Federal Reserve, 40% of Americans would struggle to cover an unexpected expense of $400.

Reducing discretionary spending and reallocating funds towards income-generating activities can accelerate your path to doubling your income.

Diversify Your Income Streams

Relying solely on a single source of income can limit your earning potential. Diversify your income streams by exploring alternative sources of revenue such as freelance work, rental income, or passive investments.

Research from the Pew Research Center shows that 44% of Americans have side jobs or gigs to supplement their income.

By diversifying your income streams, you can increase your overall earning capacity and reduce financial vulnerability.

Invest in Personal and Professional Development

Continuously invest in yourself to enhance your skills, knowledge, and expertise. Attend workshops, seminars, or online courses to expand your capabilities and stay ahead of industry trends.

According to a study by LinkedIn, employees who invest in learning and development opportunities are 47% less likely to be stressed at work.

Investing in personal and professional development allows you to position yourself for higher-paying opportunities and accelerate your income growth.

Set Stretch Goals and Take Calculated Risks

Challenge yourself by setting ambitious income targets that push you outside your comfort zone. According to research from the University of California, setting ambitious goals can lead to higher levels of performance and motivation.

Take calculated risks by pursuing opportunities that potentially have significant rewards, such as launching a new business venture or investing in high-growth industries. Setting stretch goals and embracing calculated risks can unlock new income opportunities and propel your financial growth.

Build Your Brand and Online Presence

Cultivate a strong personal brand and online presence to attract lucrative opportunities and clients. According to a survey by CareerBuilder, 70% of employers use social media to screen candidates during the hiring process.

Establish a professional presence on platforms like LinkedIn, create a portfolio showcasing your work, and actively engage with industry peers and thought leaders.

By building your brand and online presence, you can position yourself as an authority in your field and attract high-paying clients and projects.

Monitor Your Progress and Adjust Your Strategy

Regularly monitor your progress towards doubling your income and make adjustments to your strategy as needed. Track key performance indicators such as revenue growth, client acquisition, and return on investment.

According to research from the University of Cambridge, businesses that monitor their performance are 20% more likely to achieve their goals.

By staying proactive and adaptable, you can identify opportunities for optimization and ensure that you stay on track to double your income within the specified timeframe.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, these items have become valued objects, and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

The post 16 Secrets to Doubling Your Income in Just One Year first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Quality Stock Arts.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.