In a bold move, two U.S. senators have reached out to President Joe Biden with a plea to overhaul the current policy that lets packages from China enter the U.S. without duty if they are under $800 in value. This policy, they argue, puts American businesses at a disadvantage and could have significant implications for the economy and consumers alike.

Crackdown on Duty-Free Imports

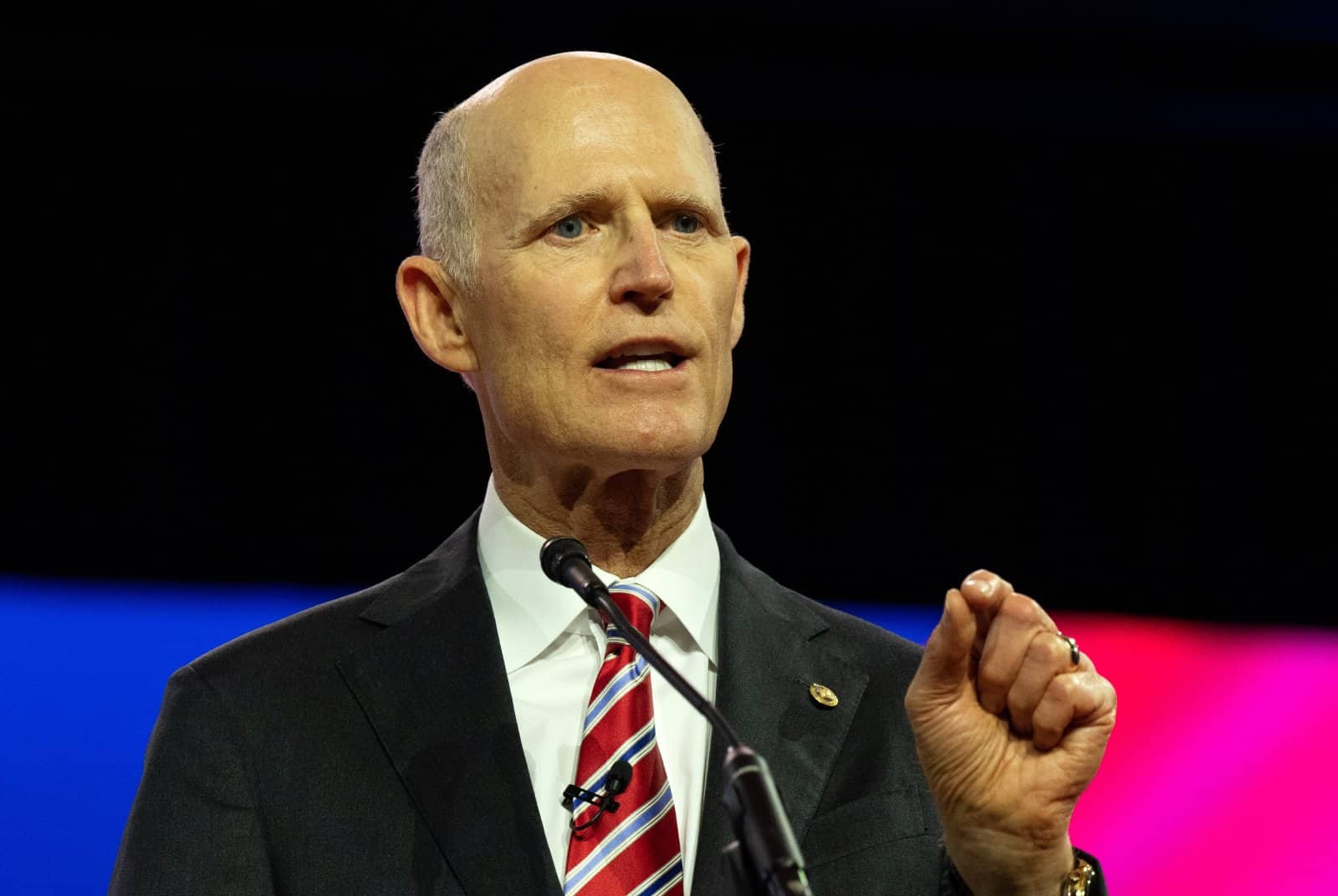

Senators Sherrod Brown and Rick Scott have raised concerns about the influx of duty-free packages from China.

They believe these imports, benefitting from the “de minimis” threshold, are harming U.S. manufacturers who can’t compete with the lower costs of Chinese goods, some of which result from forced labor and state subsidies.

The “De Minimis” Threshold

Currently, U.S. law allows for packages valued at less than $800 to bypass tariffs, a rule meant to expedite commerce and reduce consumer costs.

However, the senators argue this threshold is being exploited, particularly by Chinese online retailers, leading to a surge in shipments that disadvantage local stores and retailers.

Legislative Response

In response to the growing concern, legislation has been proposed in both houses of Congress aiming to revise how imports under $800 are handled.

The move seeks to protect American manufacturing and retail sectors from being undercut by cheaper, often unfairly subsidized foreign products.

A Call for Executive Action

Brown and Scott have taken their plea directly to the White House, urging President Biden to eliminate the duty-free status of these imports.

They highlight how this policy supports companies like Temu, Shein, and AliExpress at the expense of American businesses and workers.

Impact on Retail and Safety

The senators’ letter emphasizes the broader implications of the current policy, suggesting it not only undermines American economic interests but also poses risks to safety and livelihoods by enabling the proliferation of products made under questionable labor conditions.

White House and Trade Representative’s Silence

Despite the urgency expressed in the senators’ letter, the White House has deferred comments to the U.S. Trade Representative, who has yet to respond.

This silence leaves many wondering about the potential for policy change.

Historical Context and Business Backing

The duty-free threshold was increased from $200 to $800 in 2016 to streamline commerce and focus customs’ attention on higher-value imports.

This policy enjoys support from many in the business community for its role in facilitating quick, cost-effective consumer access to goods.

Potential Consequences for Consumers

Critics of the proposed changes warn of increased costs and delays for consumers. John Pickel of the National Foreign Trade Council argues that the convenience and lower costs currently enjoyed by consumers could be compromised, with prices potentially doubling due to additional fees and duties.

Impact on U.S. Textile Industry

The U.S. textile industry, represented by Kim Glas, has voiced support for the senators’ call to action.

The industry cites significant harm from the duty-free import policy, with several plant closures linked to the competitive pressure from imports exploiting the de minimis loophole.

A Divided Perspective

While some see the senators’ proposal as a necessary step to protect U.S. interests, others fear it could lead to higher prices and longer wait times for consumers.

This debate highlights a complex balance between protecting domestic industries and ensuring affordable access to goods for American consumers.

It also shows the challenges of globalization and the quest for fair trade practices in a digital age.

Looking Ahead

As the conversation around the de minimis threshold continues, the outcome will likely have far-reaching implications for U.S. manufacturing, retail sectors, and consumers.

A Critical Junction

With the economy and consumer interests hanging in the balance, the decision on how to proceed with the de minimis policy could set a precedent for future trade and economic policies.

Consumer Options and Impact

Should the duty-free treatment be revoked, consumers may face higher prices and fewer choices for imported goods.

The convenience of online shopping from international sellers could be dampened, prompting a shift in buying habits and potentially revitalizing local retail markets.

The Road Ahead

The administration’s response will be closely watched by businesses, consumers, and policymakers alike.

A Turning Point

The outcome will likely influence not only the future of U.S. manufacturing and retail but also the broader narrative of international trade relations.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, these items have become valued objects, and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

The post Senators Call for Change: Stop Duty-Free Imports from China first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / lev radin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.