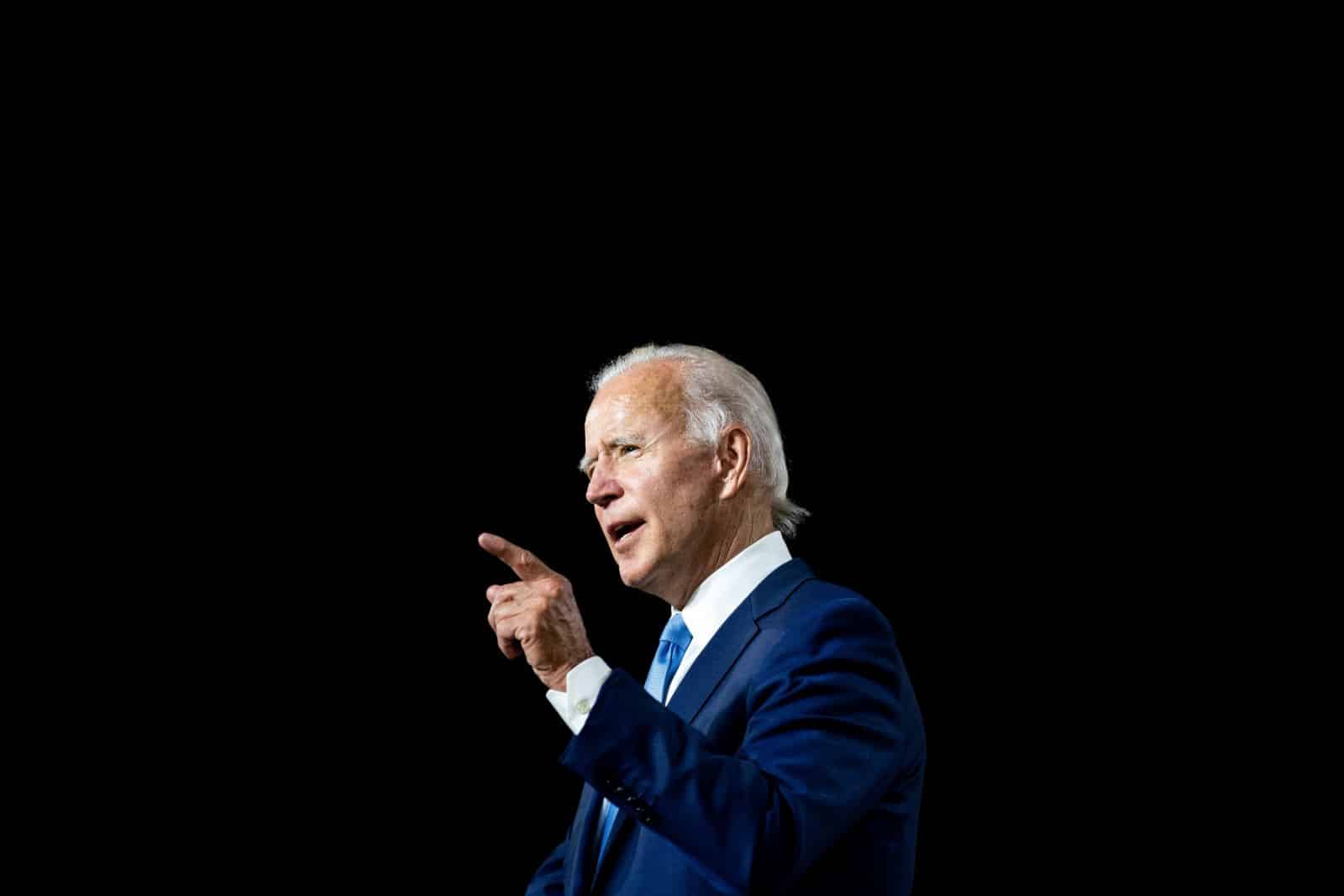

The Biden administration just announced a slew of new tariffs aimed at goods coming in from China. Let’s take a look at the details.

Focusing on Key American Industries

Biden’s team is really pushing to support key American industries like electric vehicles (EVs), clean energy, and semiconductors.

A Financial Boost

They’ve put a lot of money into these areas through laws like the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act - over $860 billion at the last count. According to the White House all this investment has paid off, leading to the creation of numerous well paying jobs.

China’s Undermining Tactics

But, according to Biden’s administration, this progress is being undermined by China - hence the new tariffs.

Forced Technology Sharing and IP Theft

The administration’s argument for these new tariffs is essentially that China has been playing dirty by forcing foreign businesses to share their technologies in order to get access to the Chinese markets and by stealing intellectual property out of the hands of other nations.

America’s Supply Chains at Risk

According to a White House fact sheet, these methods “have contributed to its control of 70, 80, and even 90 percent of global production for the critical inputs necessary for our technologies, infrastructure, energy, and health care.”

China’s Control of Global Production

From the Biden administration’s point of view, China’s dominance on the global market is putting America’s supply chains and economy at risk.

American Businesses At Risk

Biden’s team also argues that China’s subsidies and policies have led to way too much production and cheap exports, which isn’t good for American businesses.

Section 301 Tariffs on Chinese Imports

To fight this, Biden is increasing tariffs on Chinese imports under Section 301 of the Trade Act of 1974.

Failures of the Previous Trade Deal

The White House claims that “The previous administration’s trade deal with China failed to increase American exports or boost American manufacturing as it had promised.”

Nearly 800,000 New Manufacturing Jobs

According to them, Biden’s approach has already created nearly 800,000 manufacturing jobs and reduced the trade deficit with China to the lowest level in a decade.

Tariffs on Key Sectors

The new tariffs are targeting sectors where the U.S. is heavily investing to support domestic growth:

Tariffs on steel and aluminum products will rise from 0-7.5% to 25% in 2024. This aims to protect U.S. industries from China’s overproduction and high-emission products, giving an edge to cleaner American alternatives. The administration has also announced $6 billion for clean manufacturing projects in these sectors.

Semiconductor Tariffs Doubling

Tariffs on semiconductors will increase from 25% to 50% by 2025. This targets China’s rapid expansion in semiconductor manufacturing, which threatens market-driven firms. The CHIPS and Science Act includes a $53 billion investment in U.S. semiconductor production to ensure a resilient supply chain.

Electric Vehicle Tariffs Quadrupling

The tariff on electric vehicles will rise from 25% to 100% in 2024. This aims to counter China’s subsidies and overproduction, protecting U.S. investments in the EV market. The administration is supporting a robust domestic EV industry with incentives and investments in infrastructure and manufacturing.

Increasing Tariffs on Lithium-Ion Batteries

Tariffs on lithium-ion EV batteries and battery components will rise to 25% in 2024. Tariffs on critical minerals like natural graphite and permanent magnets will also increase to 25% by 2026. These actions reduce dependency on Chinese-dominated supply chains and strengthen U.S. production capacity.

Boosting U.S. Solar Industry

Tariffs on solar cells will double from 25% to 50% in 2024. This move counters China’s market dominance and encourages investment in the U.S. solar industry, which has already seen significant growth.

Tariffs on Ship-to-Shore Cranes

The tariff on ship-to-shore cranes will rise from 0% to 25% in 2024. This will support rebuilding U.S. industrial capacity and ensure the security of critical port infrastructure.

Higher Tariffs on Medical Products

Tariffs on medical products like syringes, needles, PPE, and surgical gloves will increase to 25-50% by 2024-2026. This aims to sustain domestic manufacturing capacity and counteract low-quality, underpriced Chinese imports.

What Does This Mean For The Average Joe?

But how will all this affect the average American? Well, the new tariffs could lead to higher prices for certain goods, such as steel and aluminum, electronics like smartphones and EVs, solar panels, and medical supplies. This means the average Joe may end up paying more for these items.

The Upside To All This News

However, on the upside, the tariffs are meant to protect American industries and jobs. The intention is to encourage more homegrown production of these items by making it more expensive to import them from China.

Creating New Jobs And Boosting U.S. Manufacturing

The administration is hoping that companies will make the move to produce more things in the U.S., which should lead to more jobs in manufacturing and clean energy production.

So, while there may be short-term price increases, the goal is to strengthen the U.S. economy and create a more resilient and competitive market over time.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, these items have become valued objects, and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

Featured Image Credit: Shutterstock / Engineer studio.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.