A homebuyer assistance program in California provides a down payment to some people who are purchasing homes, but there’s a caveat that buyers should be aware of.

CalHFA Dream for All Initiative Returns

California has reintroduced a program that initially started in 2022. This homebuyer assistance, conceived by Senator Toni G. Atkins, offers a loan to qualified buyers through the California Housing Finance Agency to cover up to 20% of their down payment or closing costs.

A Loan, Not a Grant

The program should not be confused with other state housing finance agency programs that often provide grants to homebuyers that do not need to be repaid.

The California Dream For All Shared Appreciation Loan Program has its own specific set of rules.

What Does the Dream for All Program Offer?

Under the Dream for All program, first-time homebuyers can apply for up to 20% of the price of the home (up to a total of $150,000). This acts as a secondary loan on the property.

Eligibility Requirements

Applicants must meet a strict set of requirements for the program.

The Fine Print

The Dream for All program is an excellent resource for hopeful homeowners who can afford their mortgage payments but need assistance with the capital for a down payment and closing costs.

However, those who wish to utilize the program should be aware of a very important condition.

What’s the Catch?

Once homeowners decide to sell their homes, 20% of their profits must be returned to the California Housing Finance Agency. This means owners will pay back more than they borrowed.

Loan Amount Must Be Repaid Regardless of Home’s Value

It’s also important to note that whether the home’s value increased or not, the initial borrowed amount still has to be repaid.

The Impact On Equity

Many homeowners rely on their home’s equity when they sell so that they will have a down payment to use for their next home purchase.

Since experts agree that appreciation is slowing, there is a good chance that once the program’s share of the profits has been surrendered, homeowners will have little left for themselves.

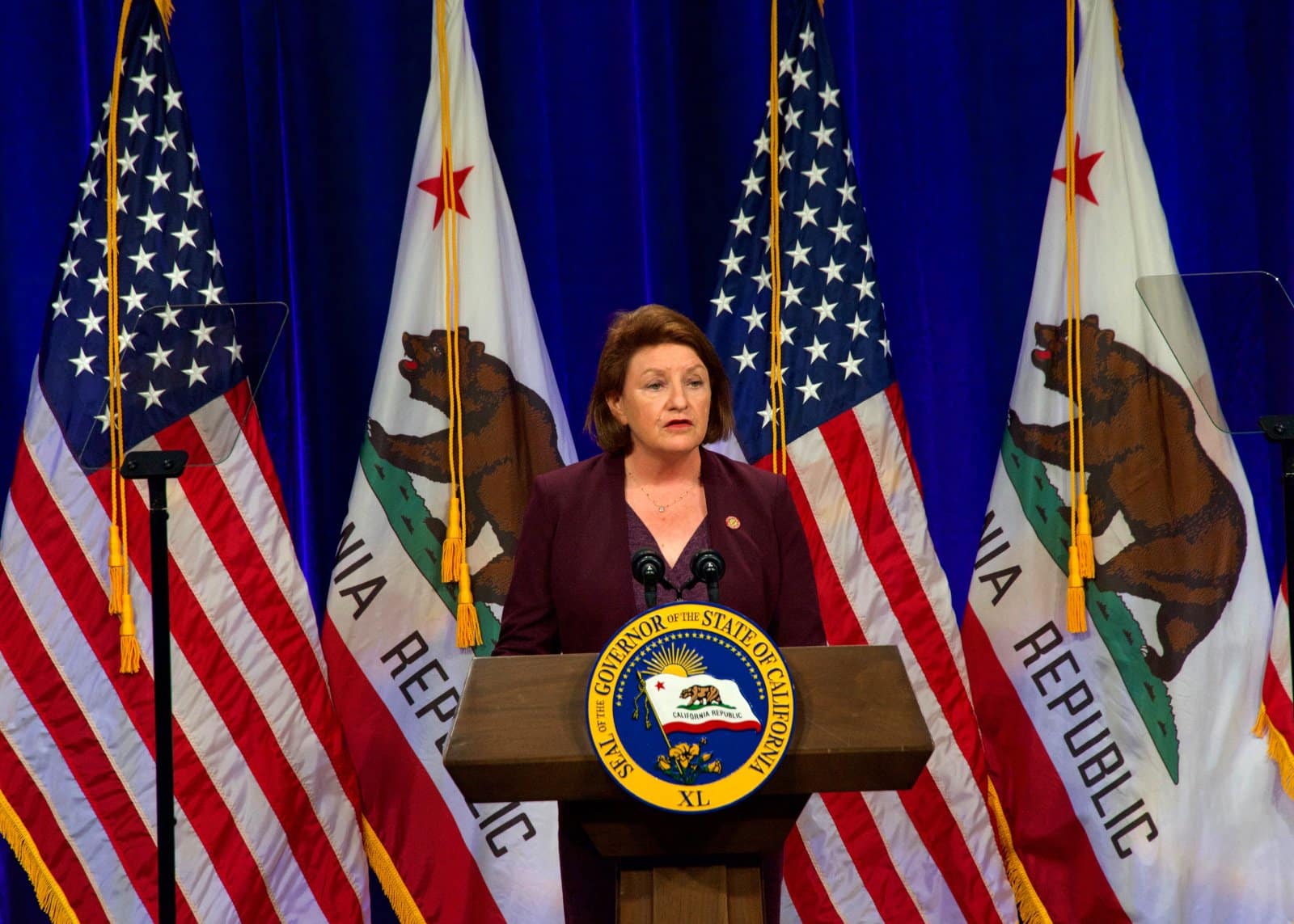

The Brainchild of a Senator

According to Senator Toni Atkins, $220 million was awarded in the state’s budget for the Dream for All program. Last year, at its inception, the program received $300 million.

Statement Gives Details on Program

The senator released a statement describing how the funds would be utilized.

First-Time, Low-Income Borrowers Prioritized

“This next round of funding will target first-generation homebuyers, with an equitable distribution to different regions of the state, and will prioritize homebuyers in the lower tiers of income eligibility,” Atkins’ statement read.

Limited Spots Available

The program has limited funds, and the California Housing Finance Agency expects to issue these loans to up to 2,000 borrowers for this year.

The Profit-Share Plan

While the initiative does require a share of the profits to be returned to the state at the time the property is sold, the state will only take 15-20% of the profit in addition to the original amount that was borrowed.

Income-Based Repayment

The percentage of the profit that has to be paid back depends on the homeowner’s income, so those who make less will be required to pay less back.

Website Gives Additional Information

The California Housing Finance Agency provides specific examples on its website to explain how repayment would work.

There are two scenarios broken down: one for moderate-income borrowers and one for low-income borrowers.

Moderate-Income Applicants

For moderate-income borrowers, the program will issue a loan for 20% of the price of the home (up to $150,000 total).

Once the homeowner decides to sell, they will pay back the amount they borrowed from the California Housing Finance Agency as well as 20% of the appreciated value.

Low-Income Applicants

For lower-income borrowers whose income is 80% or less than the area’s median income, the program works the same way, except that they will only have to pay the original borrowed amount and 15% of the appreciated value.

Consulting an Expert

Applicants of the Dream for All program should speak with an approved lender who can help determine which category applies.

The post California’s New Plan Requires Home Sellers to Share Profits first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Studio Romantic.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.