Americans aged 30-49 are falling victim to investment scams more frequently than any other age group. This revelation comes from a recent FBI report that shines a light on a troubling trend in the digital age.

Increased Vulnerability Among Millennials

The FBI’s findings reveal that millennials have reported over 13,000 investment scam complaints. This demographic’s quest for financial independence has inadvertently made them prime targets for scam operations.

Wide Range of Tactics

Scammers employ a myriad of strategies, from Ponzi schemes to fake investment platforms, exploiting victims’ trust and desire for financial gain.

Ponzi Schemes

Ponzi schemes promise high returns with little risk by using new investors’ funds to pay earlier investors. This unsustainable model inevitably collapses, leaving most participants at a loss.

Pyramid Schemes

Pyramid schemes rely on the recruitment of new members to generate returns for those at the top. Unlike legitimate multi-level marketing, these schemes offer no real product or service.

Advance Fee Frauds

Scammers trick victims into paying upfront fees for services or benefits that never materialize. Often, they promise significant returns on investments or large loans.

Forex and Binary Options Scams

Unregulated or fake brokers offer opportunities in foreign exchange and binary options trading, promising huge profits. Victims often lose their entire investment to manipulated platforms.

Real Estate Scams

Fraudulent real estate investments lure victims with the promise of high returns from property flips or rental income. Often, the properties may not exist or are significantly overvalued.

Phishing for Financial Information

Scammers use phishing emails or messages to trick victims into revealing personal financial information. This data is then used for fraudulent transactions or identity theft.

Dominance of Crypto Scams

In 2023 alone, investment fraud losses soared to $4.57 billion, with cryptocurrency scams accounting for the majority. The volatile crypto market’s promise of quick returns has become a breeding ground for fraudulent activities.

Cryptocurrency’s Role in Fraud

The report links a significant part of the fraud increase to the emergence of cryptocurrencies, which are less regulated and more susceptible to manipulation than traditional financial markets.

Lesser Impact on Boomers

Contrary to common perceptions, individuals over 60 reported fewer investment scam complaints, challenging the stereotype of elderly vulnerability to financial fraud.

Surge in Complaints

The number of complaints filed with the FBI’s Internet Crime Complaint Center has nearly doubled from 2021 to 2023. The stats show an alarming increase in investment scams across the country.

Social Media’s Influence

The Federal Trade Commission highlights social media’s significant role in the spread of investment scams, with fraudsters exploiting these platforms to attract victims.

Sophisticated Scamming Techniques

Fraudsters utilize online advertisements and social media platforms to present their scams, promising high returns with minimal risk. The wide-reaching platforms ultimately catch a diverse audience.

Impersonation and False Promises

Scammers often also impersonate public figures to give their schemes a veneer of credibility, misleading victims with fabricated endorsements and unrealistic promises.

Victims’ Stories Highlight Risks

The frauds can have devastating and life-changing impacts on victims, with some individuals reporting losses of over half a million dollars.

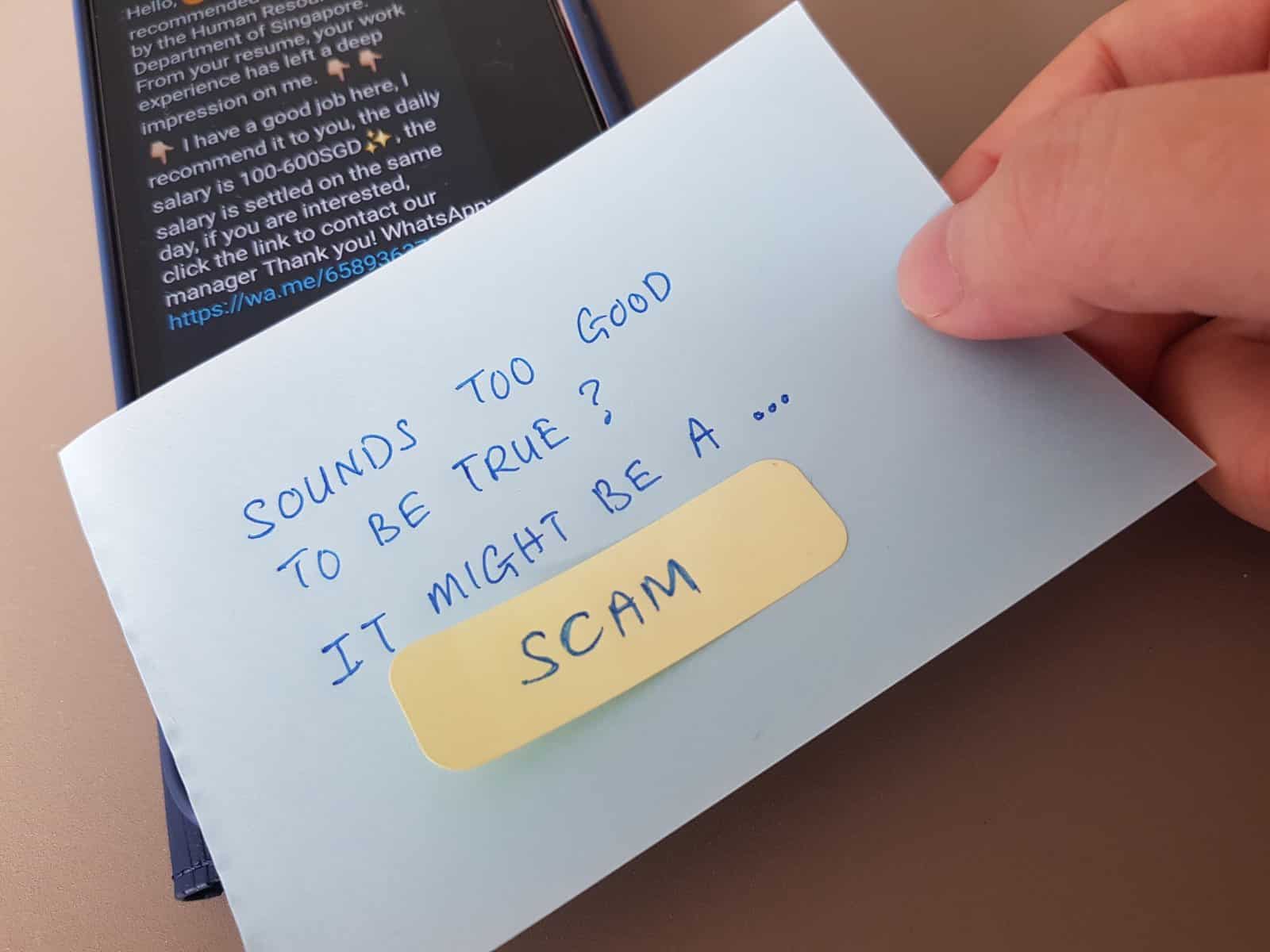

Guidance from Victims

Victims emphasize the importance of skepticism towards too-good-to-be-true investment opportunities and advocate for thorough research to avoid similar traps.

FBI’s Preventative Advice

While it sounds like common sense, the FBI recommends against transferring money or sharing financial information with unknown online entities.

Proactive Measures Against Scams

Investors need to be vigilant and proactive in protecting their assets. Armed with knowledge and some degree of caution, they can better protect their financial interests.

The Critical Need for Awareness

While regulatory bodies and financial institutions are making efforts to curb investment scams. Educating the public about the tactics and prevalence of investment scams is essential for prevention.

Focus on Legitimate Investment Avenues

Investors should also look for authentic and well-researched investment opportunities, avoiding the allure of quick gains through dubious schemes.

Stay Informed

The increasing incidence of investment scams, especially among millennials, poses a significant risk to financial security.

By adopting informed and cautious investment practices, investors can safeguard against the growing threat of financial fraud.

23 Steep Taxes Adding to California Residents’ Burden

California: a place of sunshine, innovation, and, unfortunately, some of the nation’s highest taxes. From LA’s beaches to Silicon Valley’s tech hubs, residents grapple with a maze of state taxes. Here’s a glance at 23 taxes that might surprise both Californians and outsiders. 23 Steep Taxes Adding to California Residents’ Burden

Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Time to dust off the boxes and find that once-cherished toy from your childhood. For collectors and enthusiasts, they items have become valued objects and they can be worth big bucks – are there any of these in your attic? Cash in on Nostalgia: 21 Toys Now Worth a Fortune

Millennials Don’t Buy These 19 Products Anymore

Millennials are changing consumer habits, quietly replacing once-staple products and traditions. Often criticized for their disruptive preferences, this generation is reshaping the marketplace with digital expertise, ethical buying, and a taste for the unconventional. Millennials Don’t Buy These 19 Products Anymore

10 Reasons Firearms Are Essential to America’s Fabric

Americans’ strong attachment to guns is influenced by constitutional rights, historical context, and cultural traditions. This article explores the cultural perspective driving their unwavering support for gun ownership, revealing the key factors shaping this enduring aspect of American life. 10 Reasons Firearms Are Essential to America’s Fabric

California’s 16 New Laws Raise Red Flags for Prospective Residents

California, celebrated for its beaches, tech prowess, and diversity, is now gaining attention for its recent legislation, prompting some residents to reconsider their residency. Explore the new laws of 2024 and the controversies and migration they’re stirring. California’s 16 New Laws Raise Red Flags for Prospective Residents

The post Scams Target Millennials: Young Investors, Stay Alert! first appeared on Thrift My Life.

Featured Image Credit: Shutterstock / Phoenixns.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.